Inflation

- Inflation: “Inflation is the sustained rise in the average prices

of a basket of goods and services”.

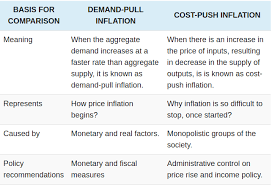

Types- According to the magnitude of inflation.

- According to the sources of inflation.

Types of inflation-based on rate

- Moderate (Low and stable – single digit)

- Galloping (High and unstable – double or triple digit)

- Hyperinflation (Extreme and uncontrollable – very large

numbers)

Two measures of Inflation

WPI (Wholesale Price Index)

- Captures the price changes in the wholesale market (B2B).

- Excludes the services sector.

- Base year = 2011-12

CPI (Consumer Price Index)

- Captures the price changes in the retail market (B2C).

- Includes both goods and services.

- Base year = 2012

WPI

- Base year updated from 2004-05 to 2011-12.

- The number of items has been expanded from 676 to 697.

- A total of 199 new items have been included and 146 old items have been excluded.

- Based on the suggestions from Saumitra Chaudhuri working committee.

- Provided by Economic Advisor (Commerce Ministry).

- Released once a month.

| base year (2011-12) | ||

|---|---|---|

| number of items | weight | |

| primary articles | 117 | 22.62 |

| fuel and power | 16 | 13.15 |

| manufactured items | 564 | 64.23 |

| total | 667 | 100 |

WPI – Ramesh Chand Committee

- Include both goods and services in the calculation.

- Increase the number of items in the basket from

697 to 1196. - Update the base year to 2017-18.

- Suggest adding more products to the list

- Herbal plants (aloe vera, menthol, fennel seed etc).

- Green tea, sanitizers, mushrooms, brown rice etc.

CPI

Previously three different types – IW, UNME and AL.

- Changed to CPI (Combined), CPI (Urban) and CPI (Rural)

- Number of items

- Rural = 448

- Urban = 460

- Combined = 299

- Base year = 2012

- Calculated by NSO

| Industrial Workers(IW) | Urban Non-Manual Employees(UNME) | Agricultural Labours (AL) | |

| base year | 2016 | 1984-85 | 1986-87 |

| number of articles | 463 | 180 | 60 |

| services included | yes | yes | no |

| published by | ministry of labour | MoSPI (Ministry of statistics and programme implementation) | ministry of labour |

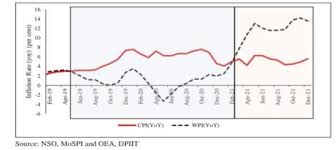

CPI & WPI – Divergence

Flexible Inflation Targeting (FIT)

- The government has delegated the responsibility of managing inflation to RBI.

- MPFA was agreed upon by GoI and RBI.

- It was signed in 2015 and implemented from 2016.

- The government has modified the RBI Act for this purpose.

- Under this framework, the central government has set the inflation target in

consultation with RBI. - According to this, RBI has to keep inflation at 4% (with a margin of 2% on either

side). - If inflation deviates from the 4% target by more than 2% for three consecutive

quarters, then RBI has to justify to the government the reasons and the measures

to restore inflation within the range. - Every 6 months, it has to publish a report indicating-the current level and the

expected trend of inflation. - The experience for last five years has shown that

- The inflation rate has stayed within the target range (2% to 6%) for most of

the time despite the uncertainties and shocks in the economy - One of the factors driving up the inflation rate in recent months has been

supply-side constraints such as rising commodity prices, which are outside

the RBI’s influence - The average inflation rate for five years (until 2021) has been around

3.47%, compared to the average of 5.7% for five years before the inflation

targeting regime - The monetary policy making process has become more transparent

Inflation Targeting – headline or Core?

Headline Inflation

- The common people are mostly affected by the rising prices of food and fuel.

- Inflation has been brought under control since the inflation target was introduced in

2016, after being in double digits for a long time. - This is not the right time to make a policy change that would allow RBI to relax its focus

on price stability.

Core Inflation

- Core inflation is a more reliable measure of inflation than headline inflation.

- Headline inflation includes the commodities whose prices fluctuate a lot.

- Price volatility may hamper the policy making process.

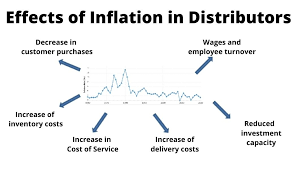

Effects of inflation

- Erodes purchasing power – the same amount of money can buy fewer

goods and services. - Lowers real rate of returns

- Returns after accounting for inflation.

- The higher the inflation, the lower the real rate of returns.

- Exports – country with higher inflation, exports become less competitive.

- Impacts investment climate.

How to control inflation?

- Reduce the money supply – RBI through the monetary policy.

- Government reduces the expenditure.

- Government increases the income tax rate.

- Households start saving more.

- Increase the production.

Other concepts

- Deflation: A decline in the average prices of goods and services.

- Disinflation: A reduction in the inflation rate or a slower increase in prices.

- Core inflation: The inflation rate that excludes the volatile items (such as food

and energy) that may distort the overall trend. - Headline inflation: The inflation rate that includes all the items in the basket of

goods and services. - Inflation Tax

- It is the loss of value of money as the prices of goods and services increase.

Stagflation - A condition where the economy faces high inflation and high unemployment at

the same time. - It is a mix of inflation and stagnation.

Base effect - The influence of the price level of the base period on the calculation of the

inflation rate in the current period. - Skewflation :

- A condition where some goods and services experience inflation while

others experience no inflation or deflation. - It was observed in India in the previous decade.

Reflation : - A policy of the government to boost the output or the growth of the

economy to overcome a slump or a contraction. - Imported inflation

A rise in the general price level due to an increase in the cost of imported

goods or services. - Wage price spiral

A feedback loop in which higher inflation leads to higher wages, which in

turn fuels more inflation.

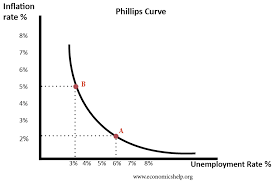

Phillips Curve

- A curve that shows the negative relationship between the inflation rate

and the unemployment rate.

Nominal (Current) and Real (Constant)

nominal= based on current market prices

real= based on prices in base year

GDP Deflator

- A measure of inflation that compares the current and base year prices of

all goods and services produced in an economy. - Indicates how much the GDP has grown due to higher prices rather than

higher output. - Includes a wider range of goods and services than other price indices.

GDP= Nominal/Real GDP

Which one of the following is likely to be the most inflationary

in its effects? [2021]

a) Repayment of public debt

b) Borrowing from the public to finance a budget deficit

c) Borrowing from the banks to finance a budget deficit

d) Creation of new money to finance a budget deficit

option d