CENTRE-STATES RELATIONS

the relation b/w CENTRE-STATES RELATIONS

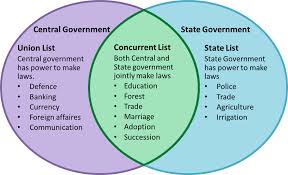

LEGISLATIVE RELATIONS

Art 245: Extra-territorial legislation – available only to

centre

Art 246: Schedule VII

Art 248: Residuary Powers

Art 249: Parliament can make laws on State list in

national interest.

Art 250 – Parliament to make laws on State List

during National emergency

Art 252 – Parliament can legislate on matter of State

List if 2 or more states agree.

Art 253 – Parliament can make laws on State List

subjects to give effect to international treaties

Sarkaria Commission Recommendation

- Residuary tax powers should remain with Parliament; nontax residuary powers should be placed in Concurrent List.

- Union laws in Concurrent areas are enforced by States;

coordination and consultation with States is essential for

uniformity. - Centre should legislate only essential aspects of Concurrent

subjects, ensuring national uniformity while States handle

details. Prior consultation with State Governments is

necessary before introducing such legislation in Parliament. - The Governor should act on bills within 1 month. The

President should dispose bills referred to him within four

months of its submission.

Punchhi Commission Recommendation

- For effective laws on Concurrent List subjects,

broad Centre-State agreement is needed. - Equal representation of states in RS

- Restore domicile qualification for RS

- The President should dispose bills referred to him

within six months of its submission.

ADMINISTRATIVE RELATIONS

- Art 256:

-States must exercise their executive power to comply

with laws made by Parliament.

-The Union can direct States to ensure this compliance. - Art 257:

-The Union can direct States to ensure their actions don’t

hinder Union’s executive power.

-This includes directions on national/military

communication infrastructure and railway protection.

-If such directions increase a State’s costs, the Union

compensates the State - Art 339(2)

- Art 347

- Art 350A

Art 339(2)

The executive power of the Union shall extend to the giving

of directions to a State as to the drawing up and execution

of schemes specified in the direction to be essential for the

welfare of the Scheduled Tribes in the State.

Art 347

On a demand being made in that behalf the President may,

if he is satisfied that a substantial proportion of the

population of a State desire the use of any language

spoken by them to be recognised by that State, direct that

such language shall also be officially recognised

throughout that State or any part thereof for such purpose

as he may specify.

Art 350A

It shall be the endeavour of every State and of every local

authority within the State to provide adequate facilities for

instruction in the mother-tongue at the primary stage of

education to children belonging to linguistic minority

groups; and the President may issue such directions to

any State as he considers necessary or proper for securing

the provision of such facilities.

Issues in Administrative Relationships

- Political Discord

- Implementation of Central Schemes

- Bureaucratic Coordination

- Emergency Powers Misuse

- Role of Governors

Coordinating Mechanisms

INTER STATE COUNCIL (Art 263)

- Set up in 1990

- Composition:

qPM

qCMs of all states

q6 Union Minister including Home Minister

qAdministrators for UTs - The body has largely remained defunct and has met only 11 times.

BODIES OUTSIDE CONSTITUTION

- Zonal Council

- Northeastern Council

ZONAL COUNCIL

- Functions:

-To prevent development of acute centre-state consciousness

-To develop the habit of cooperative working

-To make recommendation on C-S and S-S disputes - Composition :

-Chairman – HM

-CMs of state + 2 other ministers from states

-Admin of UTs

-Vice Cm – CM by rotation (for 1 year)

North Eastern Council

- Statutory advisory body for regional planning; setup by

NEC Act’71 - Members – Arunachal Pradesh, Assam, Manipur,

Meghalaya, Mizoram, Nagaland, Tripura, Sikkim - CMs + Governors of all 8 states – members

- Chairperson – nominated by President

Limitations on States’ powers to levy taxes

- Can’t levy tax on import-export.

- Can’t levy tax on inter-state trade.

- Art 276 – limit on professional tax

- Immunity of instrumentality (Art 285, 289)

- Art 287

FINANCE COMMISSION

Art 280

Qualification: FC Act’51

- Knowledge of public affairs – Chairperson

- Knowledge of finance and account of Government.

- Knowledge of economics.

- HC judge sitting/former/qualified to be one

- Experience in financial matter and administration.

Functions

It shall be the duty of the Commission to make

recommendations to the President as to:

(a) the distribution between the Union and the

States of the net proceeds of taxes which are to

be, or may be, divided between them under this

Chapter and the allocation between the States

of the respective shares of such proceeds;

(b) the principles which should govern the grantsin-aid of the revenues of the States out of the

Consolidated Fund of India;

c) the measures needed to augment the

Consolidated Fund of a State to supplement the

resources of the Panchayats in the State on the

basis of the recommendations made by the

Finance Commission of the State;

d) the measures needed to augment the

Consolidated Fund of a State to supplement the

resources of the Municipalities in the State on

the basis of the recommendations made by the

Finance Commission of the State;

Issues in Centre-States Financial Relations

- Borrowing from Centre

- Dependency on Central Grants

- Excessive central dominance over fiscal

resources - Pay commission Awards

- Most lucrative subjects of state list have

been practically monopolized by centre.

LEGISLATIVE RELATIONS B/W CENTRE AND STATE

Art 245: Extra-territorial legislation – available only to

centre

Art 246: Schedule VII

Art 248: Residuary Powers

Art 249: Parliament can make laws on State list in

national interest.

Art 250 – Parliament to make laws on State List

during National emergency

Art 252 – Parliament can legislate on matter of State

List if 2 or more states agree.

Art 253 – Parliament can make laws on State List

subjects to give effect to international treaties